The History of ADT

From 1867–Today:

The #1 security provider in America has a remarkable history, which began with a stock ticker. Check out all the changes ADT has gone through over the years.

1867

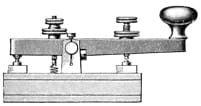

Gold and Stock Telegraph Company

Edward Calahan invents the stock ticker and forms the Gold and Stock Telegraph Company. This opens the door for New York brokerage firms to get up-to-the-minute information from the stock exchange floor. The Gold and Stock Telegraph Company also develops a messenger system that sends instructions to and from the stock exchange floor.

1870

The Break-In and

New Security System

The president of the Gold and Stock Telegraph Company, Elisha Andrews, wakes up and finds a burglar in his home. Calahan creates a telegraph-based alert system for Andrews' home and eventually connects 50 of Andrews' neighbors to a central station where all the alert boxes are monitored. This system quickly expands throughout New York City.

1874

American District

Telegraph is Formed

Calahan helps create the American District Telegraph (ADT) Company, which consolidates over 50 local alert system companies in the New York area.

1870s–80s

Police and Fire Alerts

ADT expands its messenger and alarm services to include standardized police and fire alerts, in addition to messenger services for calling doctors and carriages.

Early 1900s

Rise of the Roundsmen

ADT develops a service that sends messenger watchmen, also known as “roundsmen,” around neighborhoods. The roundsmen’s job is to check in at signal boxes at designated times, which indicates to ADT headquarters that neighborhoods are secure.

1901

Western Union Buys ADT

The President of Western Union, Colonel R.C. Clowry, buys a controlling interest in 80 Direct Messenger Companies, including the original New York-based ADT. He consolidates these businesses under the name American District Telegraph. Clowry sees the long-term benefit of security services and the eventual decline of messenger services, so he separates the two within the company and makes ADT the security services branch of the business.

Early 1909

Purchased by AT&T

In an effort to expand its communication network, AT&T; buys Western Union and its subsidiary, ADT

1914

AT&T Monopoly

Just five years after the Western Union acquisition, the Justice Department declares AT&T; a monopoly and forces it to sell its interests in Western Union, ADT, and other subsidiary companies.

1920s–1930s

Technological Expansion

ADT continues to expand and create new technology for burglar and fire alarm systems.

1964

ADT Monopoly

ADT controls over 80% of the security business in the U.S. and is ruled a monopoly by the Justice Department. As a result, ADT is forced to adopt a uniform national price list and service offerings.

1969

ADT Goes Public

ADT becomes a publicly traded company on the New York Stock Exchange, which prompts expansion overseas.

1970s

The Central Station

ADT continues to revolutionize the security industry with new technology and creates the first automated "Central Station" call center.

1974

Microcomputing

ADT introduces microcomputer based security systems, which replace the old telephone network based call boxes.

1980s

Safewatch

ADT continues to transform by introducing Unimode fire systems, Safewatch residential systems, and the central station monitoring, which is the focus of ADT today.

1984

Renamed ADT Security

Lord Ashcroft, the owner of the Bermuda-based Hawley Group, Ltd., buys Crime Control, Inc., the 4th largest security company in the U.S. Later that year, he buys ADT, which merges with Crime Control Inc. Ashcroft renames the company ADT Security Systems, Inc.

1994

One Million Customers

ADT adds 180,000 new customers and reaches the 1 million customer mark after 120 years in business.

1997

Purchased by Tyco

Tyco International Ltd. acquires ADT. Lord Ashcroft sells most of his company stock and joins the Tyco board of directors.

2010

Broadview Becomes ADT

ADT pays $2 billion to acquire Broadview Security (formerly Brinks), the 2nd largest security company in the U.S.

2012

ADT Goes Public (Again)

Tyco International introduces ADT as an independent, publicly traded company.

Today

America's #1 Security Provider

ADT continues to be the #1 security provider in America, offering business and residential security monitoring services to over 6 million customers across the U.S.